Payyo Payment Gateway

Payment solutions built for tours and activities.

Get a demoPayment solutions built for tours and activities.

Get a demo

Payyo was created for tour and activity companies. We understand the complexities and quirks of the industry like no other payment provider.

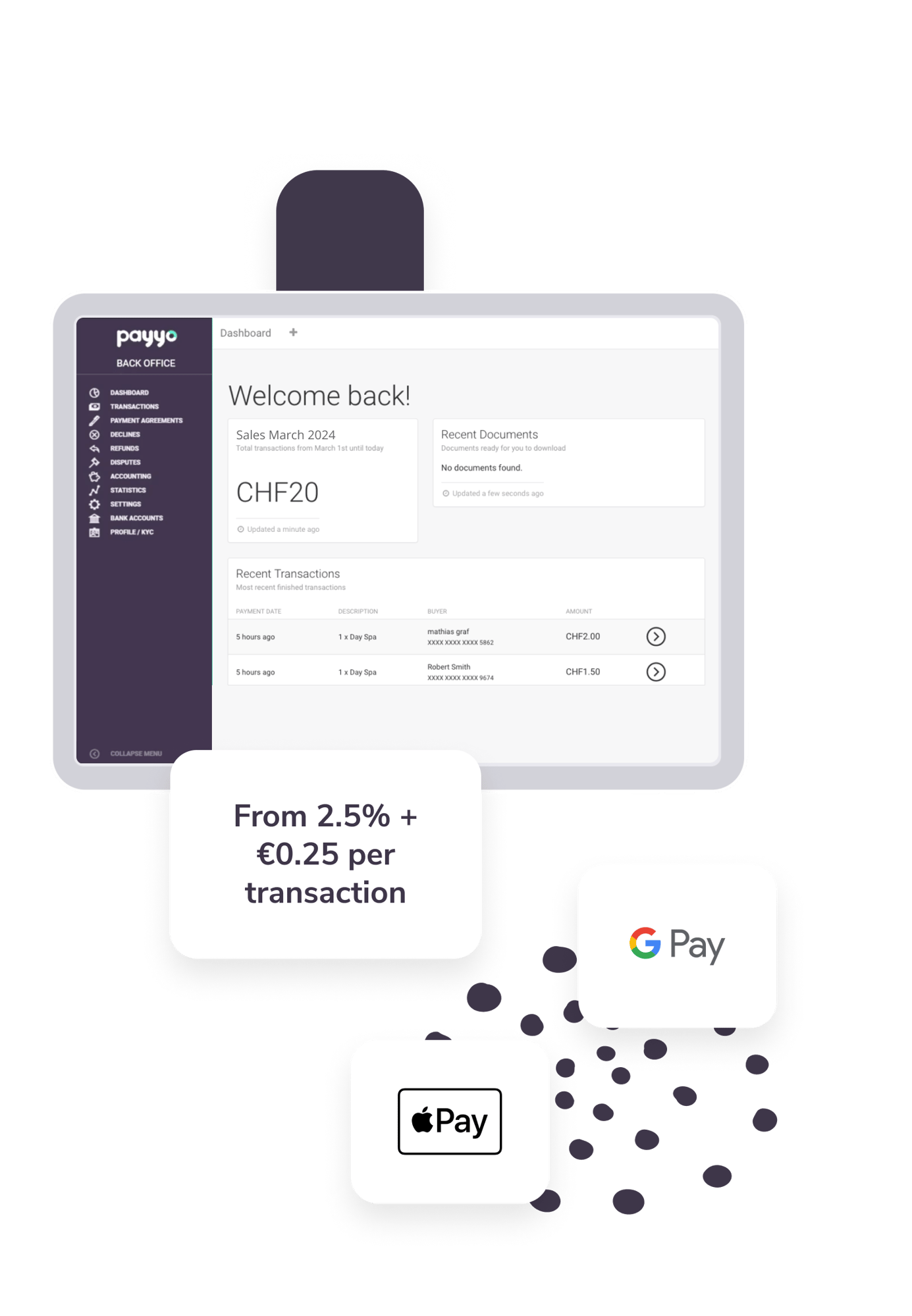

We offer the most competitive transaction fees on the market, starting at 2.5% + €0.55 per online transaction. Offline transaction fees are capped at €0.55 to cover booking management services.

Payyo is enabled by SIX, a PCI II compliant payment service provider, rated A by Moody Credit Rating.

Payyo supports payouts in 37 currencies, including EUR, CHF and NOK. Set up your payout preferences and we'll transfer the money to your specified bank account coin your local currency.

With over a dozen payment methods available, including Google and Apple Pay, let your customers choose how to pay you.

While you take bookings and payments from customers around the world, we'll keep an eye out for fraud and protect your business as it grows.

We leverage our industry expertise to strike a healthy balance between accepting payments and flagging suspicious transactions for further inspection.

If you need to issue a refund or resolve any disputes or chargebacks, Payyo will help liaise with banks on your behalf so you don't have to.

Find out how we can help you grow

Born in Interlaken, the adventure capital of Europe

We've been part of the travel industry since 2010 and we love it. We're driven to help operators grow, one booking at a time.

An omni-channel booking system

We believe operators can accelerate growth when they sell on multiple, relevant sales channels. We're building solutions to get you there.

Work with website conversion experts

From the moment you sign up, work closely with our team to optimise your website and tour content to convert more website visitors to bookers.

Personalised support from the very start

We're here to help you make the best decision for your business. To kick things off, we'll work with you to understand your requirements to make sure we're the perfect fit for your business.

We understand the tour and activity industry and you can rely on our team to onboard your business, introduce you to digital best practice, and guide you to success.

2010-2023 TrekkSoft | A TrekkSoft Group company