This blog is an extract from our eBook 'Latin America Trend Report 2019' written by Stephanie Kutschera, Franziska Wernet & Nicole Kow. You can get your free copy here.

For our Latam Tourism Survey 2019, we had 165 participants from 15 different Latam countries. These were mainly located in Peru (18.5%), Mexico (16.7%), Colombia (13%), Chile (12.3%) and Ecuador (8.3%).

32% of participants run (half) day tours, 26% were multi-day tour operators, followed by travel agents (17%), DMO/DMCs (9%) and 5% resellers. The majority of these companies had around up to 5 employees (62%).

Latin American incoming tourism

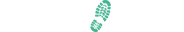

In terms of the target groups, we see a huge domestic focus with 30% welcoming travellers from the surrounding Latin American countries, followed by European tourists with 27% and North America with 26%. The Asian market is fourth place with 8.5%, followed by Oceania with 5.4%.

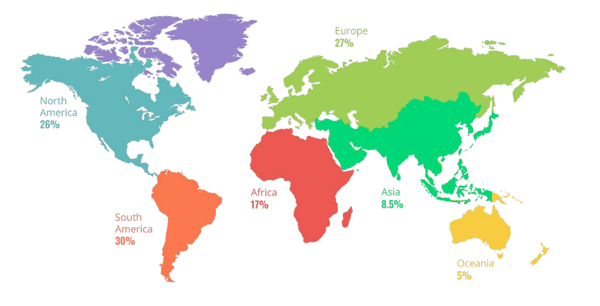

According to their target group focus, participants are offering their tours and activities mainly in Spanish (36%) and English (32%). Less represented are tours in Portuguese, French and German. And only 3.2% stated to offer their tours in Mandarin.

Driving booking channels for LATAM tour operators

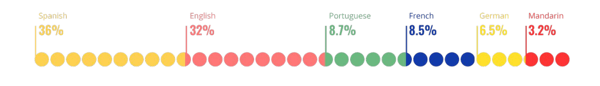

For tour and activity companies there are different ways of addressing customers and receiving bookings. As part of a balanced distribution strategy we at TrekkSoft always suggest not to be dependent on one single channel, but to aim for an equalized sales strategy based on direct and indirect bookings.

For our survey participants the most important sales drivers for their businesses are direct via their own website, phone or email (75%), followed by Social Media (46%) and Google Search (45%). Less important drivers are Destination companies like DMOs, tourism boards or DMCs and online travel agencies.

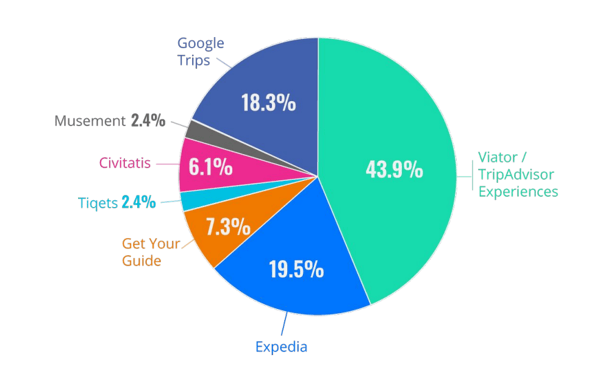

Those operators that work with OTAs stated that Viator/ TripAdvisor Experiences (43.9%) brings the best return for their business, followed by Expedia (19.5%) and GetYourGuide (7.3%). If we compare these results with our Tourism Survey Results 2018, it shows that also on a worldwide scale, Viator is the channel that according to the participants “is providing the best return for their business”, followed by Google Trips, Expedia and Get Your Guide.

Technologie use in LATAM

We also asked a few of questions regarding the use of technology tools to simplify reservation and management processes to see how important technology is for their businesses.

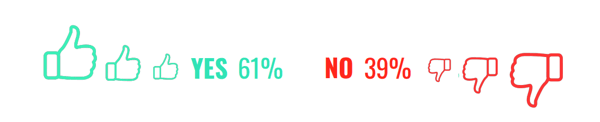

61% of the survey participants offer a booking option via their own website. This aligns with the results from our Tourism Survey 2018 where 64.6% are actually offering a booking option on their website, compared to our Industry Research from 2016 where only 53% offered it via their own website.

62% of participants said they are not using a booking system on their website, what means that most of the participants stating to use a booking option probably refer to a booking form to send a request rather than a direct online booking option. Additionally, 61% of the survey participants don’t manage reservations via a mobile device.

Biggest challenges for tours and activities operators

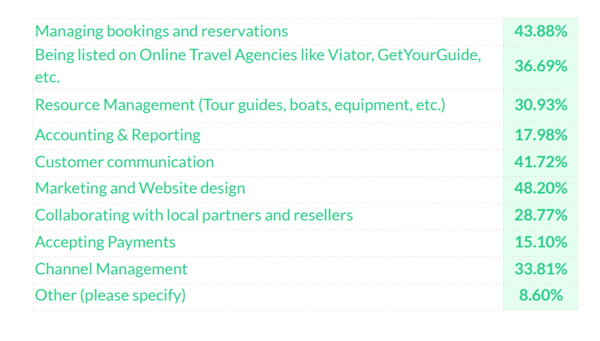

From our survey results we see that there are three key challenges, tours and activities operators are dealing with: Marketing & website design, managing bookings, and automated communication.

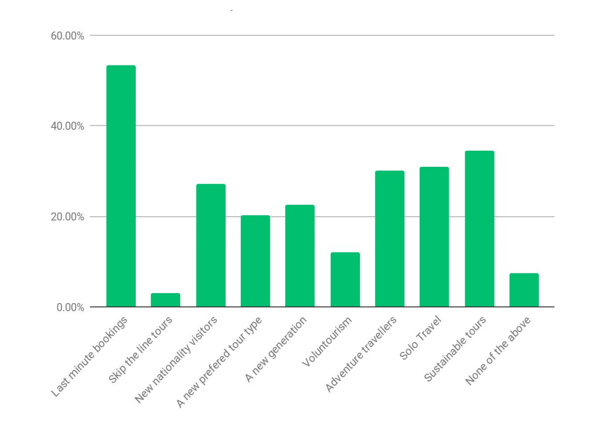

We also asked what key trends do tours and activities operators see in their region. One key trend is last minute bookings with 22%, followed by sustainability (14%), solo travellers (13%), adventure tourism (12.5%) and other nationalities (11%). These results correspond with our tourism survey results from September 2018, where also last minute bookings was the major trend with 39%.

Compared to the results from the tourism survey, it is interesting to see that “Skip the line tours” as a trend has not such a big focus for operators. Trends such as sustainability and also adventure tourism play a higher role in Latam countries. These play a key part in the reason why a lot of travellers are coming to these countries, expecting amazing nature and lots of adventure opportunities.

Participants mentioned that also Voluntourism - a combination of volunteering

and tourism - is a growing trend in Latam countries.

“ We see growth in the Millennials that want to do

some volunteer activity, such as teaching English or

how to help build something.”

Read more about the Latin American market and its trends in our LATAM Travel Trend Report 2019: