"TrekkPay has been a lifesaver. We now process all our transactions internally and we stopped using a third party since the beginning of 2017. Our records are more accurate. They can easily be compiled and printed at the end of each month which saves us on accounting time. We also take advantage of the TrekkSoft marketplace which we are still exploring by talking to the major vendors being added constantly. The card readers are the only ones that work in our region as well so that’s a super plus!"

- Dario from Exuma Escapes

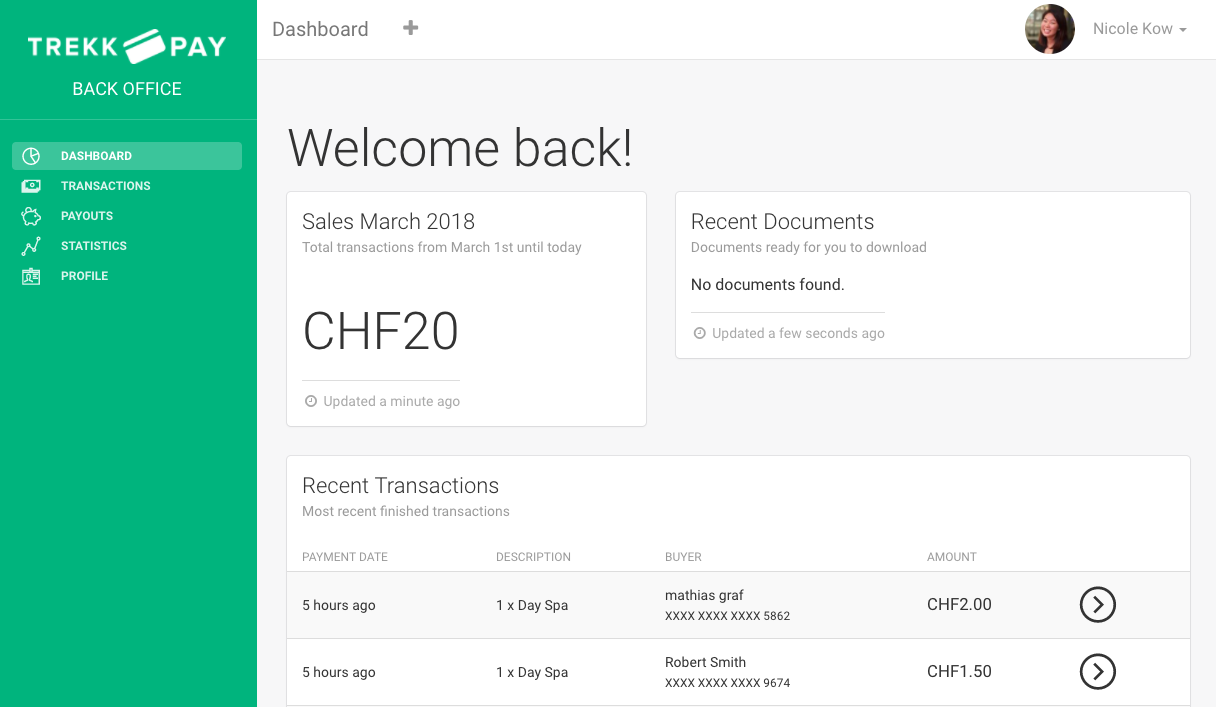

TrekkPay is a payment gateway built and designed for the tour and activity sector.

In the last few months, the TrekkPay team has worked hard to build a dashboard that gives you an overview of all your transactions and payouts to help you improve your accounting and reporting.

1. Built in Know Your Customer process

When getting started, new customers will be asked to complete TrekkPay's Know Your Customer process before accessing the dashboard.

It's simple to do this.

First, agree to TrekkPay's terms and conditions with an electronic signature. Then, fill out your information about your company and upload the required legal documents.

You documents will be reviewed and approved within 2 business days.

2. Recent transactions

The dashboard will display your most recent transaction including all the payment details for each transaction. Issue a refund directly from the dashboard or export your transaction data at any time.

Any refunds made in TrekkPay will be shown in your TrekkSoft account too.

Learn more about TrekkPay, the ultimate payment solution for tour and activity operators here.

3. Payout overview

Previously, we were aware that users found it difficult to get updated payout figures and had to rely on Sales and Turnover reports to find this data.

With TrekkPay, you'll be able to easily retrieve this information from the Payouts tab.

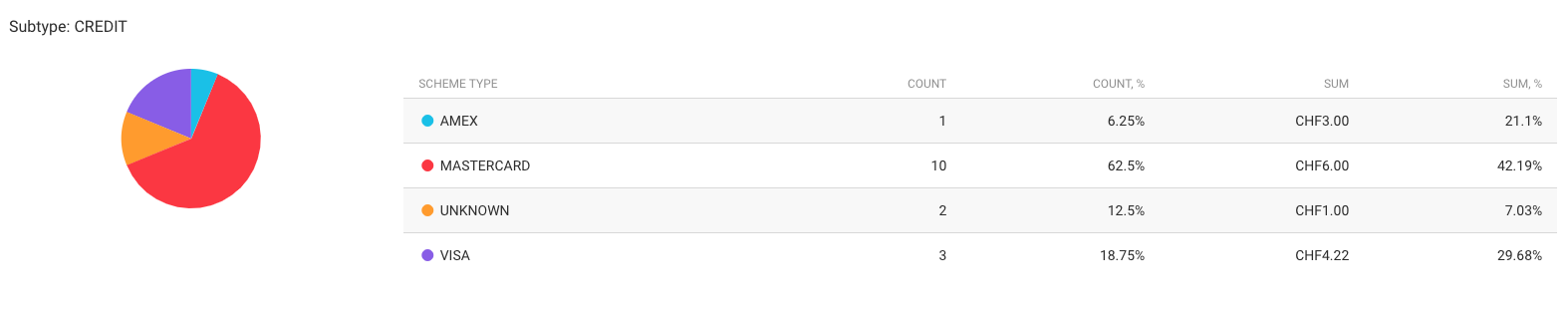

4. Funding instrument types

With TrekkPay, you'll be able to see what method of payment customers frequently use.

Don't have access to you dashboard yet? Contact your Account Manager or email support@trekksoft.com to get help.

Facts and figures about TrekkPay

Never heard of TrekkPay? Here are some facts you need to know about this payment gateway.

- Your transaction fees are capped at 3.5% + €0.60 per transaction. For companies with high booking volume, the transaction fee can be negotiated.

- TrekkPay is enabled by SIX, a PCI II compliant payment service, and rated A by Moody Credit Rating.

- No additional conversion fees or cross border transaction fees.

- Free management of disputes of chargebacks.

- Get a dedicated account manager to oversee your TrekkPay transactions.

- Opt to have your money credited to your bank account or credit card for €5.

- Work in major currencies and accept payments from customers worldwide.*

|

AED |

CHF |

EUR |

HUF |

KWD |

NZD |

RON |

SEK | TRY |

| AUD | CNY |

GBP |

ILS |

MAD |

OMR | RSD | SGD | USD |

|

BHD |

CZK | HKD | KWD |

MXN |

PLN | RUB | THB |

ZAR |

|

CAD |

DKK |

HRK |

JPY |

NOK |

QAR |

SAR |

TND |

|

*TrekkPay works in all countries except Cuba, Iran, North Korea, Myanmar, Sudan and Syria.

Reasons why TrekkPay is perfect for tour and activity companies worldwide

Firstly, TrekkPay comes with all TrekkSoft plans, allowing companies of all sizes and budgets to streamline your booking, management and payment solutions even further.

.png?t=1524060224873&width=600&height=320&name=Split%20payment%20(1).png)

Set up split payments to automate payouts to multiple partners when you connect with via the Partner Network. If you work with many TrekkSoft partners, let our system handle the payments for you and save yourself time, energy and additional bank transfer fees.

With TrekkPay, you can also enable pre-authorisation of credit cards which is especially useful if you first need to manually confirm a tour before charging a customer. For example, if you run hot air balloon tours and your trips depend on weather conditions, you can first check the weather conditions for that specific date before charging your customers.

Want to learn more about TrekkPay? Speak with us today!