This blog is an extract from our eBook 'Travel Trends Report 2019' written by Stephanie Kutschera & Nicole Kow. You can get your free copy here.

In recent years we have seen a distinctive shift in the reliance and trust of mobile phones and it makes sense considering 62.9% of the population own a smartphone and on average spend between 3.5 to 5 hours using it daily.

Industry research

Google conducted a study with PhocusWright in 2018 to discover how mobile phones are used by potential travellers. Findings of this study confirmed that researching destinations, hotels and airfares on a mobile device, is now as normal to users as online shopping.

Customers are comfortable researching, booking and planning their entire trip to a new travel destination on a mobile device. Top consumer markets displaying this trend include India who came out top with 87%, Brazil (67%), Japan (59%), South Korea (53%), US (48%), Australia & United Kingdom (45%) and France (44%).

Mobile devices also lead to a greater propensity to book at the last-minute. Google Data shows that travel-related searches for “tonight” and “today” have grown over 150% on mobile, over the past two years.

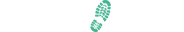

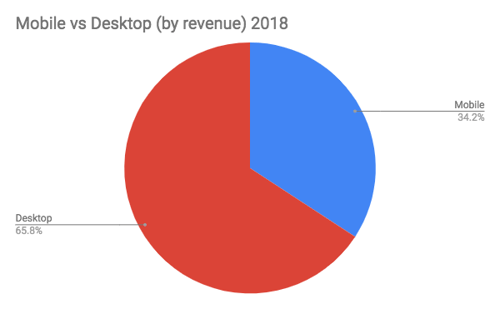

Mobile vs desktop bookings

Our own data on mobile bookings is made up of bookings via TrekkSoft’s mobile booking widget and white label apps we’ve built on request. We further define desktop bookings as those that have been made on and a company’s website or via a widget on a reseller’s website.

Diagram 1: Mobile vs Desktop bookings in 2018

.png?width=500&name=imageLikeEmbed%20(2).png)

Diagram 2: Mobile vs Desktop bookings in 2017

.png?width=500&name=imageLikeEmbed%20(1).png)

The proportion of mobile bookings increased between 2017 and 2018, from 51.5% to 56.7%.

As consumers get more comfortable booking via a mobile device, tour and activity companies are now beginning to realise its importance and invest in building a bespoke mobile optimised site. This trend will only continue to grow in 2019.

In 2018, revenue from desktop bookings fell from 73.2% to 65.8%.

While mobile bookings make up more than half of the bookings processed via TrekkSoft, a large part of revenue still comes through desktop bookings.

Diagram 3: Mobile vs Desktop revenue in 2018

Diagram 4: Mobile vs Desktop revenue in 2017

To explain this, we know from previous research that consumers tend to book and pay for expensive items first, such as flight tickets and accommodation. We also know the mobile booking experience still lags behind the desktop experience.

This could lead to consumers doing their research on mobile, and later booking via desktop.

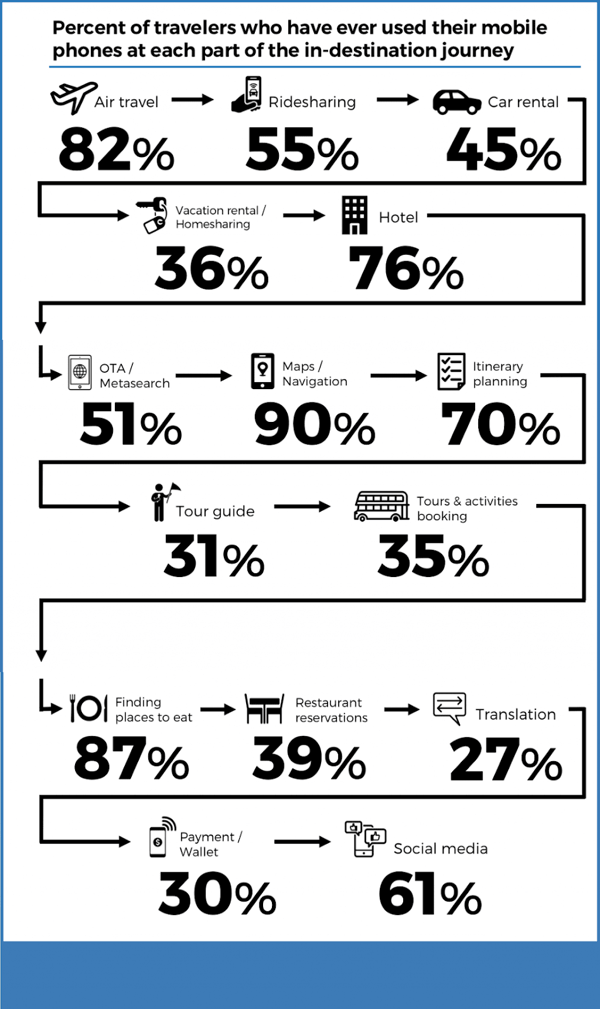

In-destination bookings

Skift’s Research found that 35 percent of travellers have used mobile phones to book a tour or activity while already in destination for a vacation, whilst Phocuswright found that 38% of bookings are made on the same day or two days before a trip is made.

Get the full ebook for more insights to promote in-destination booking: